Editor’s note

For historical information, view opinion survey results from previous years.

In Missouri, land sale prices are not required to be reported to any government or public agency. In turn, it is challenging to understand current prices and forward-looking projections for the state’s farmland values. This report summarizes results from a web-based survey conducted by the University of Missouri Extension Agricultural Business and Policy program, which aims to provide insight into perceived changes in land values across Missouri’s farmland market. This information supplements state-level estimates published by the U.S. Department of Agriculture (USDA) National Agricultural Statistics Service (NASS).

The most recent survey was conducted in July 2024 and collected 263 responses. Of the 263 respondents, 29% were farmers or landowners, 18% were lenders, 8% were farm managers, 4% were government employees, 4% were appraisers and 41% were from other occupations. Each respondent was invited to report land values for cropland, pastureland, timberland and hunting/recreation land for up to three counties, based on their knowledge of a sales transaction that occurred in the previous 12 months. The survey captured 1,035 land value observations.

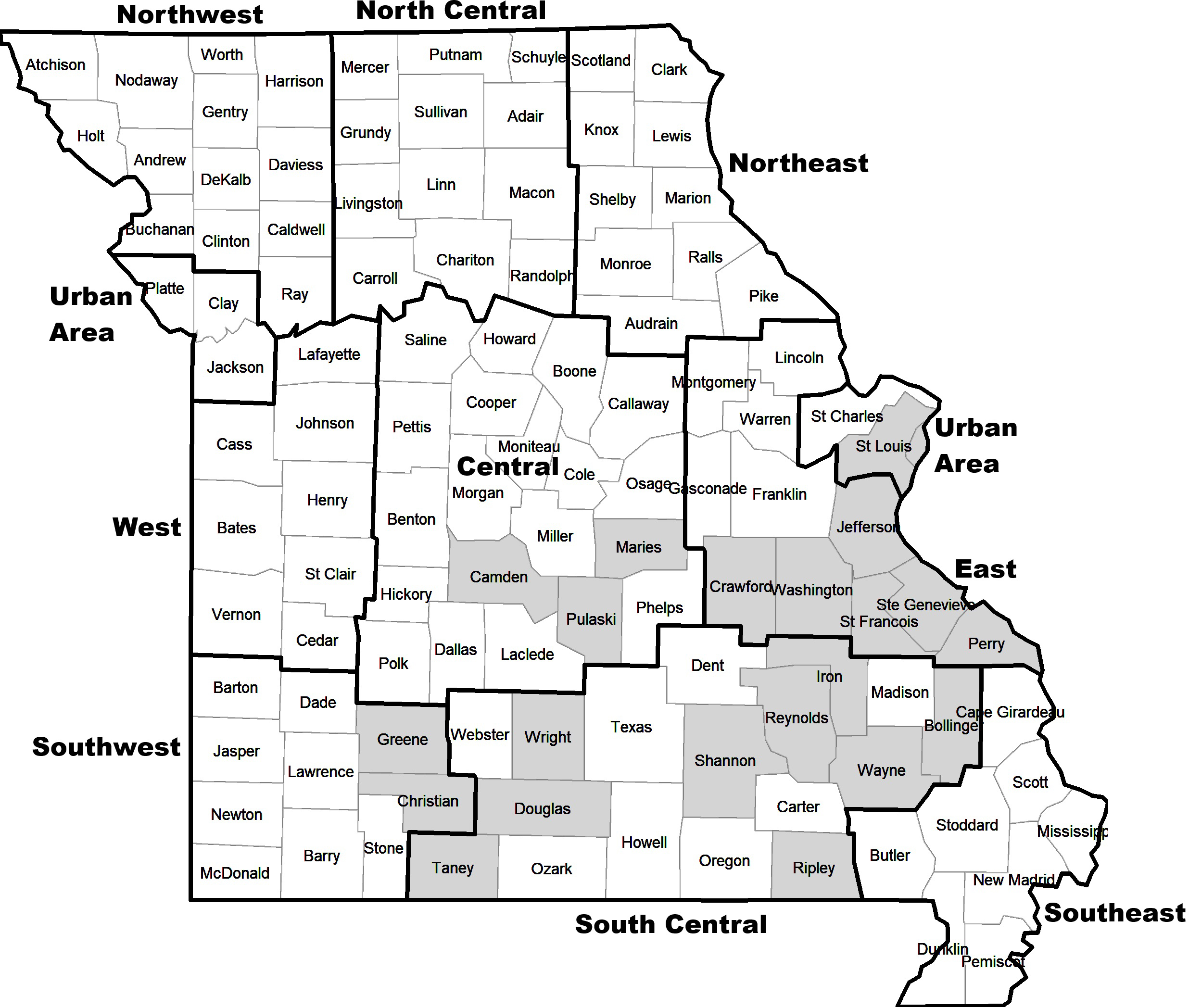

USDA Agricultural Statistics District (ASD) boundaries were used to aggregate the data, capturing variation in geography, climate and cropping practices. This categorization divides Missouri into nine regions: Northwest, North Central, Northeast, West, Central, East, Southwest, South Central and Southeast. A tenth region was created for the state’s urban areas, comprising Clay, Jackson, Platte, St. Charles and St. Louis counties. Figure 1 denotes the regions with dark borders. Counties in gray indicate areas where no survey responses were collected, preventing the survey authors from reporting on farmland value opinions.

Average value of land

Respondents were asked to provide estimates of land values for three classes of cropland and pastureland (good, average, poor), irrigated cropland, timberland (with valuable trees), and hunting/recreation land (with little productive agricultural value but desirable aesthetic qualities). “Good” land is defined as land with yields more than 10% above the county average; “poor” land is defined as land with yields more than 10% below the county average.

Table 1 reports farmland values (in dollars per acre) at the state and regional levels, based on the 2024 Missouri farmland values opinion survey data. The table also displays percentage changes in reported statewide values from 2023 to 2024. In Missouri, the average value of “good” nonirrigated cropland was $8,524 per acre, a $107 decrease (−1.2%) from 2023. The average statewide value of “average” nonirrigated cropland was $6,996 per acre, a 0.7% increase. Irrigated cropland was reported at a statewide average of $10,124 per acre, up $445 per acre (4.6%) from 2023. “Good” pastureland was estimated at $5,687 per acre statewide, up $547 (11%) from 2023 estimates. The statewide average for timberland was up $526 to $4,520 per acre and for hunting/recreation land was up $327 to $4,710 per acre.

Table 1. Farmland values (dollars per acre) based on 2024 Missouri Farmland Opinion Survey.

| Cropland | Pastureland | Timberland | Hunting or recreation land | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Irrigated | Good | Average | Poor | Good | Average | Poor | Average | Average | |

| State | |||||||||

| State average | 10,124 | 8,524 | 6,996 | 5,556 | 5,687 | 5,043 | 4,344 | 4,520 | 4,710 |

| Percent increase from last year | 4.6% | −1.2% | 0.7% | 0.5% | 11% | 11% | 13% | 13% | 7.5% |

| Region | |||||||||

| Northwest | 11,037 | 8,915 | 6,874 |

5,244 |

5,409 | 4,735 | 3,995 | 4,401 | 4,602 |

| North Central | 10,333 | 8,167 | 6,135 | 5,013 | 4,663 | 4,400 | 3,689 | 3,839 | 4,046 |

| Northeast | 12,833 | 9,912 | 7,906 | 6,396 | 6,415 | 5,756 | 5,017 | 4,780 | 5,218 |

| West | 8,933 | 8,202 | 7,140 | 6,048 | 6,215 | 5,444 | 4,817 | 4,344 | 4,514 |

| Central | 9,636 | 7,863 | 6,830 | 5,422 | 5,848 | 5,254 | 4,432 | 4,680 | 4,415 |

| East | 11,689 | 10,988 | 9,249 | 7,253 | 7,056 | 5,999 | 5,533 | 6,157 | 6,981 |

| Southwest | 5,531 | 5,650 | 4,563 | 3,906 | 4,320 | 3,883 | 3,688 | 3,300 | 3,530 |

| South Central | 6,688 | 6,194 | 5,203 | 4,219 | 4,547 | 3,776 | 3,181 | 3,741 | 3,525 |

| Southeast | 10,658 | 9,694 | 8,094 | 5,583 | 5,625 | 4,950 | 3,860 | 4,010 | 3,870 |

| Urban Area | 22,833 | 13,833 | 11,750 | 9,625 | 9,389 | 8,556 | 7,278 | 8,417 | 10,517 |

The results suggest land values tend to be highest in urban areas and lowest in the Southwest and South Central regions. Timberland and “poor” pastureland had the largest statewide increase (13%), followed by “good” and “average” pastureland, both with 11% increases. Based on observations collected in 2024, cropland values were flat compared to the 2022–2023 survey. It should be noted that the averages may be impacted by year-to-year changes in geographic response rates.

Who bought and sold farmland in the last 12 months?

Survey respondents were asked for their opinion on who bought and sold farmland in Missouri, based on their experience and observations. Respondents could choose from six listed choices of buyers.

Responses suggested a split in buyers of Missouri farmland (Table 2). Local farmers were believed to account for 21% to 45% of buyers across the state of Missouri, whereas investors accounted for 23% to 38%, followed by recreational land and lifestyle buyers at 10% to 31%. New farmers and institutions were believed to account for less than 17% of buyers.

Table 2. Types of Missouri farmland buyers in the past 12 months.

| Region | Local farmers | Relocating farmers | New farmers | Investors | Institutions | Recreational land and lifestyle buyers |

|---|---|---|---|---|---|---|

| Northwest | 35% | 1% | 10% | 23% | 4% | 28% |

| North Central | 35% | 2% | 5% | 31% | 0% | 27% |

| Northeast | 36% | 5% | 2% | 25% | 0% | 31% |

| West | 38% | 0% | 0% | 31% | 2% | 29% |

| Central | 36% | 1% | 8% | 26% | 2% | 27% |

| East | 28% | 3% | 5% | 28% | 10% | 25% |

| Southwest | 21% | 14% | 7% | 29% | 0% | 29% |

| South Central | 30% | 12% | 12% | 21% | 0% | 26% |

| Southeast | 45% | 3% | 3% | 21% | 17% | 10% |

| Urban Area | 25% | 0% | 0% | 38% | 13% | 25% |

In a follow-up question, survey respondents were provided a list of four options and asked their opinion about the buyer’s plan for the land (Table 3). Respondents felt that at least 30% of the buyers who purchased land in Missouri planned to farm the land themselves, 30% to 46% planned to use it for nonfarming purposes (includes hunting, recreation, development and other uses), and about 20% to 30% planned to rent out the land. In the East and Southwest regions, 10% of buyers planned to develop renewable energy such as solar and wind.

Table 3. Buyers’ plans for purchased Missouri farmland.

| Region | Operate the farm themselves | Rent out the land | Develop renewable energy (solar or wind) | Use for hunting and recreational purpose |

|---|---|---|---|---|

| Northwest | 39% | 25% | 5% | 31% |

| North Central | 39% | 32% | 1% | 27% |

| Northeast | 44% | 27% | 0% | 29% |

| West | 42% | 21% | 5% | 32% |

| Central | 45% | 20% | 1% | 34% |

| East | 32% | 28% | 10% | 30% |

| Southwest | 26% | 30% | 9% | 35% |

| South Central | 46% | 4% | 4% | 46% |

| Southeast | 55% | 32% | 0% | 14% |

| Urban Area | 36% | 36% | 7% | 21% |

Surveyed participants were also asked their opinion on who sold farmland in the previous 12 months and were allowed to select from five types of sellers. On average, 30% to 52% of sellers were retired farmers across the state of Missouri except for urban areas. Of observerd farmland sales, 30% to 60% were thought to have originated from estate sales, 10% to 20% from investors, and less than 25% from active local farmers and institutions (Table 4).

Table 4. Types of Missouri farmland sellers in the past 12 months.

| Region | Active local farmers | Retired farmers | Estate sales | Institutions | Investors |

|---|---|---|---|---|---|

| Northwest | 5% | 35% | 42% | 4% | 15% |

| North Central | 11% | 35% | 38% | 2% | 15% |

| Northeast | 6% | 34% | 45% | 0% | 15% |

| West | 0% | 52% | 42% | 0% | 6% |

| Central | 17% | 37% | 34% | 0% | 12% |

| East | 2% | 40% | 47% | 2% | 9% |

| Southwest | 19% | 31% | 35% | 0% | 15% |

| South Central | 24% | 29% | 29% | 0% | 18% |

| Southeast | 0% | 41% | 59% | 0% | 0% |

| Urban Area | 8% | 15% | 54% | 8% | 15% |

A follow-up question asked respondents to indicate the primary reason land was being sold. On average, respondents believed 30% to 50% of people who sold Missouri farmland did so because of advantageous market prices. Family succession planning was also a factor in selling farmland, especially in the Southeast region. About 10% to 20% of sellers were motivated by the need for cash and less than 15% were adjusting their investment portfolio (Table 5).

Table 5. Sellers’s reason for selling Missouri farmland.

| Region | Good market prices | Need cash | Part of family succession plan | Adjust investment portfolio |

|---|---|---|---|---|

| Northwest | 32% | 16% | 42% | 10% |

| North Central | 44% | 12% | 38% | 6% |

| Northeast | 44% | 5% | 38% | 13% |

| West | 52% | 0% | 41% | 7% |

| Central | 45% | 17% | 31% | 6% |

| East | 51% | 12% | 34% | 2% |

| Southwest | 47% | 16% | 32% | 5% |

| South Central | 50% | 9% | 38% | 3% |

| Southeast | 35% | 9% | 57% | 0% |

| Urban Area | 27% | 20% | 40% | 13% |

Factors affecting land values

The survey also asked respondents what factors they thought were influencing farmland values. Many responded that interest rates, weather, and crop and cattle prices were significant factors in farmland values. Higher interest rates may impact farmers’ willingness to pay for land; however, not every farmer needs to finance land purchases. Based on the 2024 survey, some respondents felt farmers that purchased land held strong cash positions.

Limited land available for sale and strong demand from investors were viewed as factors that pushed up the price of land. Many respondents also noted that urban sprawl and land development might play roles in the Missouri farmland market.

Outlook

Survey respondents also shared expectations regarding farmland values in 2025 (Table 6). Overall, respondents forecasted land prices would increase 2.7% for cropland, 2.9% for pastureland and 2.3% for noncrop and nonpastureland. The forecasted changes in cropland and pastureland values in the Northwest region of Missouri were highest. Average land values in the North Central region were expected to decline. Noncrop and nonpastureland values in the West and South Central regions were forecast to increase about 6% to 7% in 2025.

Table 6. Respondents’ expectations about farmland values in 2025.

| Region | Average cropland value | Average pastureland value | Average other land value |

|---|---|---|---|

| Northwest | 6.6% | 5.7% | 1.2% |

| North Central | −1.4% | −0.2% | −1.6% |

| Northeast | 0.1% | 0.2% | 0.1% |

| West | 5.5% | 5.4% | 7.4% |

| Central | 1.8% | 2.9% | 2.0% |

| East | 2.8% | 3.7% | 1.0% |

| Southwest | 1.9% | 3.9% | 3.5% |

| South Central | 5.8% | 4.6% | 6.7% |

| Southeast | 0.3% | 1.7% | 0.9% |

| Urban Area | 3.1% | 1.6% | 1.4% |

USDA land value data

Table 7 reports the August 2024 USDA estimates of average land values for Missouri and surrounding states. The USDA’s $4,910 estimate for Missouri cropland is $2,086 lower than the value reported by survey respondents for “average” cropland. For pastureland, USDA estimates the value at $2,650 per acre, or $2,393 less than the survey estimate. The point of comparison also varies between these data sets — the MU Extension survey asks only for land values, whereas USDA data includes the value of all land and buildings on farms.

Table 7. USDA agricultural land values in dollars per acre, August 2024.

| State(s) | Cropland | Pasture | Farm real estate3 |

|---|---|---|---|

| Missouri | 4,910 | 2,650 | 4,800 |

| Arkansas | 3,600 | 3,270 | 4,110 |

| Illinois | 9,550 | 3,970 | 8,700 |

| Iowa | 9,800 | 3,500 | 9,420 |

| Kansas | 3,300 | 2,100 | 2,970 |

| Corn belt1 | 8,560 | 3,000 | 7,930 |

| United States2 | 5,570 | 1,830 | 4,170 |

| 1. Includes Indiana, Illinois, Iowa, Missouri and Ohio. 2. Average of the 48 continental states. 3. Farm real estate is an estimate of the land and all buildings on a per acre basis. |

|||