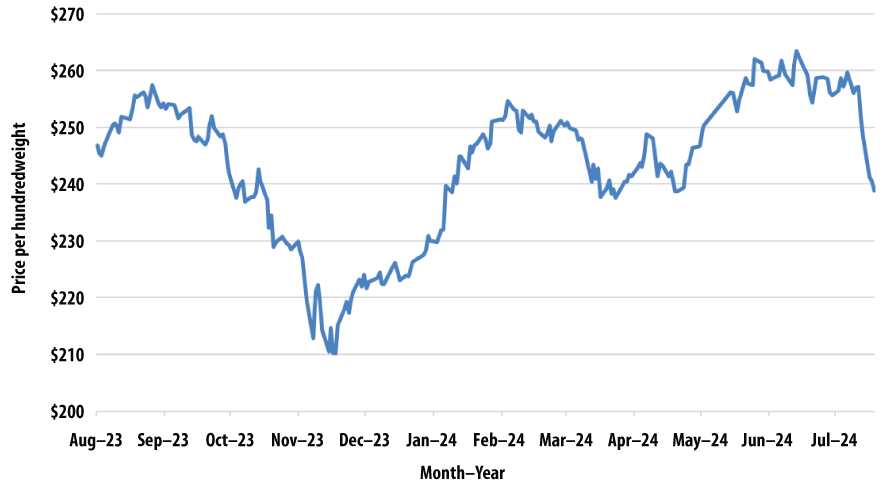

Livestock risk protection (LRP) insurance offers producers a way to manage risk associated with declining livestock prices (see Figure 1 for feeder cattle future prices). It does not protect against other perils such as disease or death. The U.S. Department of Agriculture’s (USDA) Risk Management Agency (RMA) administers LRP insurance products. It is sold by approved livestock insurance agents throughout the year (running from July 1 to June 30). LRP premiums may be subsidized by the federal government if the producer meets conservation compliance, and additional subsidy is provided for beginning farmers or ranchers or veteran farmers or ranchers. Policies are available in Missouri for feeder cattle, fed cattle and swine. Insured producers receive an indemnity when the actual ending value of livestock, as determined by RMA, is less than the coverage price chosen by the producer.

Figure 1. Nearby feeder cattle futures demonstrate that price volatility can present a challenge to livestock producers.

How LRP insurance works

A producer must use an agent authorized to sell livestock insurance. The producer fills out an application to determine eligibility. Once the application is accepted by USDA, the producer can purchase a specific coverage endorsement (SCE). An SCE requires specific information regarding the livestock to be insured:

- Number, livestock type and target weight

- End date (based on insurance period)

- Coverage price

- Ownership share (percentage)

Producers indicate the type of livestock to be covered and estimate their target weights at the end of the insurance period. Breed, sex and target weight category will adjust coverage prices for feeder cattle. The end date should be close to when livestock are to be marketed or reach desired weight. The coverage price is a percentage of the livestock’s expected ending value at a contract’s expiration date. Producers must also indicate their share of ownership (must be greater than 10%), which adjusts the insured value accordingly.

When can you buy a policy?

Feeder cattle, fed cattle and swine policies can normally be bought on most weekdays, excluding holidays and when related USDA reports (Cattle on Feed; Hogs and Pigs) are announced. The time frame for purchasing an SCE starts at 3:30 p.m. and ends at 8:25 a.m. Central time the next morning. Coverage and prices are determined daily by a series of data sets and calculators on the RMA website. If the RMA website offers no coverage and prices, producers will be unable to purchase LRP insurance for that day. The RMA also reserves the right to suspend sales at any time due to market limitations or volatility.

Premiums

Premiums are paid at the end of the insurance period. Premium costs increase when selecting higher coverage levels and longer insurance periods. Premium costs are subsidized by the federal government, but the producer must be in conservation compliance to qualify. The percent of subsidy varies by the coverage level selected:

- 55% for a coverage level of 70% to 79.9%

- 50% for a coverage level of 80% to 84.9%

- 45% for a coverage level of 85% to 89.9%

- 40% for a coverage level of 90% to 94.9%

- 35% for a coverage level of 95% to 100%

If you qualify as a beginning farmer or rancher or veteran farmer or rancher, your premium subsidy will generally be 10 percentage points higher than the standard subsidy.

Premiums are calculated in a multistep process detailed below. LRP coverage prices, rates, and producer premium costs are publicly reported by RMA.

Indemnity

Indemnities (after premium costs are deducted) are paid at the end of the insurance period. Payments are based on the difference between the actual ending value and the coverage price selected by the producer. If the actual ending value is higher than the coverage price, no indemnity will be paid. To collect the indemnity, a Notice of Probable Loss form must be submitted within 60 days of the policy’s end date. Proof of ownership or sales records are required before the indemnity is paid. Payments will be made within 30 days of a properly filed claim.

If the livestock is sold more than 60 days before the SCE end date, producers cannot receive an indemnity and they do not get the premium payment back unless their share is properly transferred. Any animals that die or are quarantined during the insurance period should be reported within 72 hours to avoid reducing the endorsement.

Feeder cattle policy

LRP insurance for feeder cattle can provide coverage for calves (born or unborn), steers, heifers, predominantly Brahman or predominantly dairy cattle (Table 1). Ending weights can be between 100 and 599 pounds (Weight 1) or between 600 and 1,000 pounds (Weight 2). Producers select an available insurance period (ranging from 13 to 52 weeks) ending close to when they expect to market their cattle. Feeder cattle producers can select a coverage level ranging from 75% to 100% of the expected ending value. A maximum of 12,000 head of feeder cattle can be insured under a single SCE, and only 25,000 head between the period July 1 to June 30.

Table 1. LRP feeder cattle snapshot.

| Type of cattle | Calves (born and unborn), steers, heifers, Brahman cattle or dairy cattle |

|---|---|

| Selling weights | 100 to 599 pounds or 600 to 1,000 pounds |

| Insurance period | 13, 17, 21, 26, 30, 34, 39, 43, 47 or 52 weeks |

| Coverage level | 75%, 80%, 85%, 87.5%, 90%, 92.5%, 95%, 96%, 97%, 98%, 99% or 100% |

| Ending value base | CME feeder cattle index |

| Maximum per SCE | 12,000 head |

| Maximum per year | 25,000 head |

LRP insurance uses the Chicago Mercantile Exchange (CME) feeder cattle index to set ending values. This index uses feeder cattle transactions and reports from 12 major feeder cattle states, including Missouri. A price adjustment factor (Table 2) is used to calculate the coverage price and ending value for the livestock type from the cattle index.

Table 2. Price adjustment factors for feeder cattle.

| Cattle type | Weight 1 (100 to 599 pounds) |

Weight 2 (600 to 1,000 pounds) |

|---|---|---|

| Steers | 110% | 100% |

| Heifers | 100% | 90% |

| Unborn steers or heifers | 105% | N/A |

| Predominantly Brahman | 100% | 90% |

| Unborn predominantly Brahman | 100% | N/A |

| Predominantly dairy | 50% | 50% |

| Unborn predominantly dairy | 50% | N/A |

Fed cattle policy

A fed cattle policy is fairly similar to a feeder cattle policy. Steers and heifers expected to finish select or higher quality grade, and yield grade one to three are insurable (Table 3).

Insured fed cattle must weigh between 1,000 and 1,600 pounds live weight when marketed for slaughter at the end of the insurance period. If sales records do not contain live weight, then live weight can be calculated by dividing the hanging weight by 0.6325.

Producers select an available insurance period (ranging from 13 to 52 weeks) ending closest to when they will market their cattle. Fed cattle producers can select a coverage price from 75% to 100% of the expected ending value. This policy can insure up to 12,000 head under a single SCE. A total of 25,000 head between the period July 1 to June 30 can be insured.

The price of fed cattle (expected and actual ending value) in the LRP policy is determined by the five-area weekly weighted average direct slaughter cattle price reported by the USDA Agricultural Marketing Service. The price category represents live basis steer sales, 35% to 65% choice.

Table 3. LRP fed cattle snapshot.

| Type of cattle | Any heifers or steers |

|---|---|

| Selling weights | 1,000 to 1,600 pounds |

| Insurance period | 13, 17, 21, 26, 30, 34, 39, 43, 47 or 52 weeks |

| Coverage level | 75%, 80%, 85%, 87.5%, 90%, 92.5%, 95%, 96%, 97%, 98%, 99% or 100% |

| Ending value base | Five-area weekly weighted average direct slaughter cattle, steers, 35% to 65% choice |

| Maximum per SCE | 12,000 head |

| Maximum per year | 25,000 head |

Swine policy

LRP swine policies allow producers to insure market hogs (born and unborn) as detailed in Table 4. Target weight requirements dictate that swine under LRP coverage must weigh between 140 and 260 pounds on a lean (dressed weight) basis. To convert to live weight, use the lean conversion factor of 0.74. This adjustment would reflect live weights of 189 to 351 pounds. Insurance periods are offered for unborn swine before the SCE (up to 52 weeks) and swine born before the SCE (up to 30 weeks). Swine producers can select a coverage price of 75% to 100% of the expected ending value. Contract and yearly limits state that 70,000 head can be covered under a single SCE, and 750,000 head can be insured between the period July 1 to June 30.

Swine expected and actual end values are based on the price series used to settle the CME lean hog futures contract. This weighted average price is derived from two producer sold data series — negotiated and swine or pork market formula prices — reported by the USDA Agricultural Marketing Service.

Table 4. LRP swine snapshot.

| Type of swine | Market hogs |

|---|---|

| Selling weights | 189 to 351 pounds (live) 140 to 260 pounds (lean) |

| Insurance period | 13, 17, 21, 26 or 30 weeks (born) 30, 34, 39, 43, 47 or 52 weeks (unborn) |

| Coverage level | 75%, 80%, 85%, 87.5%, 90%, 92.5%, 95%, 96%, 97%, 98%, 99% or 100% |

| Ending value base | Weighted average price of lean hogs (based on negotiated and swine or pork market formula price data series) |

| Maximum per SCE | 70,000 head |

| Maximum per year | 750,000 head |

LRP example

A producer in Missouri plans to sell 100 feeder cattle steers at a target ending weight of 750 pounds each. This is estimated to occur closest to the 21-week insurance period. This person owns 100% of the cattle. After reviewing LRP quotes, the producer would like to select a coverage price of $245.16 (which is a 96% coverage level). The price adjustment factor is 100% for steers in this weight range (see Table 2), so the coverage price remains $245.16 per hundredweight ($245.16 × 100%). Subsidy rate is 35% for a 96% coverage level. The LRP quote reports an actuarial rate of 0.027508.

Premium calculation

Indemnity calculation

Using the above example, the actual ending value is reported at $227 per hundredweight at the end of the insurance period. Use the following steps to determine your net gain or loss from an LRP plan.

Advantages of LRP

- Provides protection against declining livestock prices that could affect a farmer’s ability to obtain a positive return.

- Allows producers flexibility in number of animals to insure — ranging from one head to the maximum head limitations per endorsement or year.

- Performs similarly to a put option in the futures market in protecting downside price risk.

- No broker commissions or margin calls.

- Coverage prices updated daily and coverage available in all months.

- Subsidies available to lower producer premium costs.

- Premiums due at the end of the insurance period.

Disadvantages of LRP

- Actual ending values are based on regional or national livestock prices. Basis risk exists, and producers need to understand their local market.

- Occasional unavailability of LRP policies due to market limitations or swings.

- Once LRP policies are accepted by RMA, producers are locked into coverage and selling timelines.

Resources

The guide is for educational purposes only. The information in this guide does not replace or supersede any procedures or modify any provisions contained in the complete insurance policies.

Original authors

Ryan Milhollin, Ray Massey, Bryce Bock